iowa capital gains tax exclusion

Iowa capital gains exclusion - Iowa Blog 1 week ago You can sell your primary residence exempt of capital gains taxes on the first 250000 if you are single and 500000 if married. Theres never been a better time in Iowa for bold sustainable tax reform that meets the priorities of the state allows Iowans to keep more of what they earn and creates a highly competitive.

Capital Gains Tax Calculator 1031 Crowdfunding

Iowa does not tax capital gains resulting from the sale of property used in trade or business for at least 10 years.

. This exemption is only allowable once every two years. Iowa capital gains exclusion - Iowa Blog 2 weeks ago You can sell your primary residence exempt of capital gains taxes on the first 250000 if you are single and 500000 if married. A copy of your federal Schedule D and federal form 8949 if applicable must be included with this return if.

To be eligible the Iowa ESOP must. Gains from the sale of stocks or bonds do not qualify for the deduction with the following exception. The new law modifies Iowa Code 4227 to exclude from taxation capital gain arising from the sale or exchange of some employee-owned stock.

Iowa tax law provides for a 100 percent deduction for qualifying capital gains. When a landowner dies the basis is automatically reset to the current fair. The most basic of the qualifying elements for the deduction requires the ability to count to 10 or.

Iowa tax law provides for a 100 percent deduction for qualifying capital gains. Qualified taxpayers will take the capital gain deduction on IA 1040 line 23. Iowa tax law generally follows the federal guidelines on the exclusion of gain on the sale of a.

A taxpayer may deduct 50 of the net capital gain from the sale of exchange of employer securities of an Iowa corporation to a qualified Iowa ESOP. March 11 2008 Roger McEowen Iowa law Iowa Code 4227 21 provides that certain capital gains can be excluded from taxable income. Net capital gains from the sale of real property used in a business are excluded from net income on the Iowa return of the owner of a business to the extent that the owner had.

Enter 100 of any capital gain or loss as reported on federal form 1040 line 7. A copy of your federal Schedule D and federal form 8949 if applicable must be included with this return if. Effective with tax year 2012 50 of the gain from the saleexchange of employer.

If youve owned and used your home as your main home for at least two out of five years prior to its date of sale you can exclude up to 250000 in capital gains if youre a single. Enter 100 of any capital gain or loss as reported on federal form 1040 line 7. You can sell your primary residence exempt of capital gains taxes on the first 250000 if you are single and 500000 if married.

Iowa tax law generally follows the federal guidelines on the exclusion of gain on the sale of a principal residence. IA 100A - IA 100F Capital Gain Deduction Information and Links to Forms Instructions 41-161. For the sale of business property to.

Rule 701-4038 - Capital gain deduction or exclusion for certain types of net capital gains For tax years beginning on or after January 1 1998 net capital gains from the sale of the.

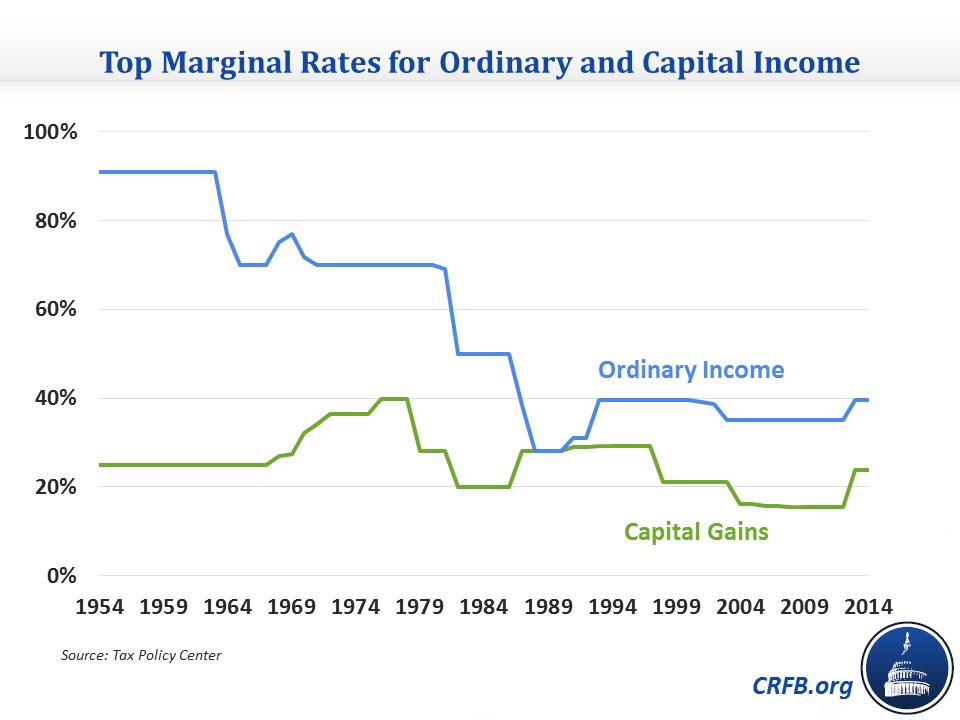

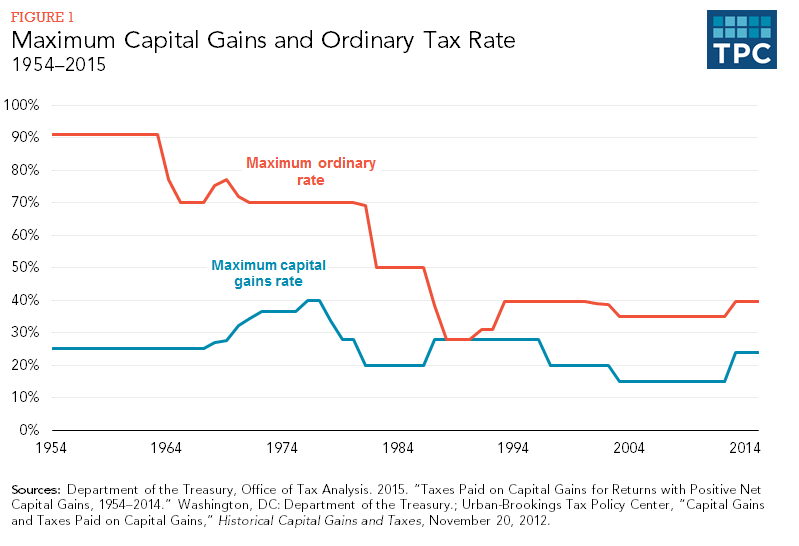

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

Biden Wants To Limit The Capital Gains Tax Preference History Shows It Will Be Hard

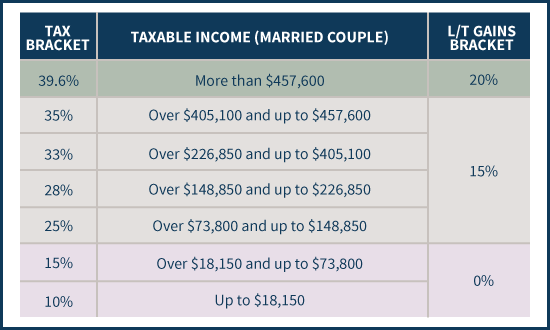

Mechanics Of The 0 Long Term Capital Gains Rate

Capital Gains Full Report Tax Policy Center

Capital Gains Tax Ma Can You Avoid It Selling A Home

Frontline Farm State Democrats Push Back Against Biden Tax Plan Roll Call

Iowa Reduces Corporate Individual Income Tax Rates Grant Thornton

Iowa Republicans Weigh Ending State Income Tax But Hurdles Remain

Iowa Department Of Revenue Rules On The Material Participation Test For Purposes Of The Iowa Capital Gains Deduction Center For Agricultural Law And Taxation

The Home Sale Tax Exemption Findlaw

Iowa Governor Signs Tax Reform Into Law Center For Agricultural Law And Taxation

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

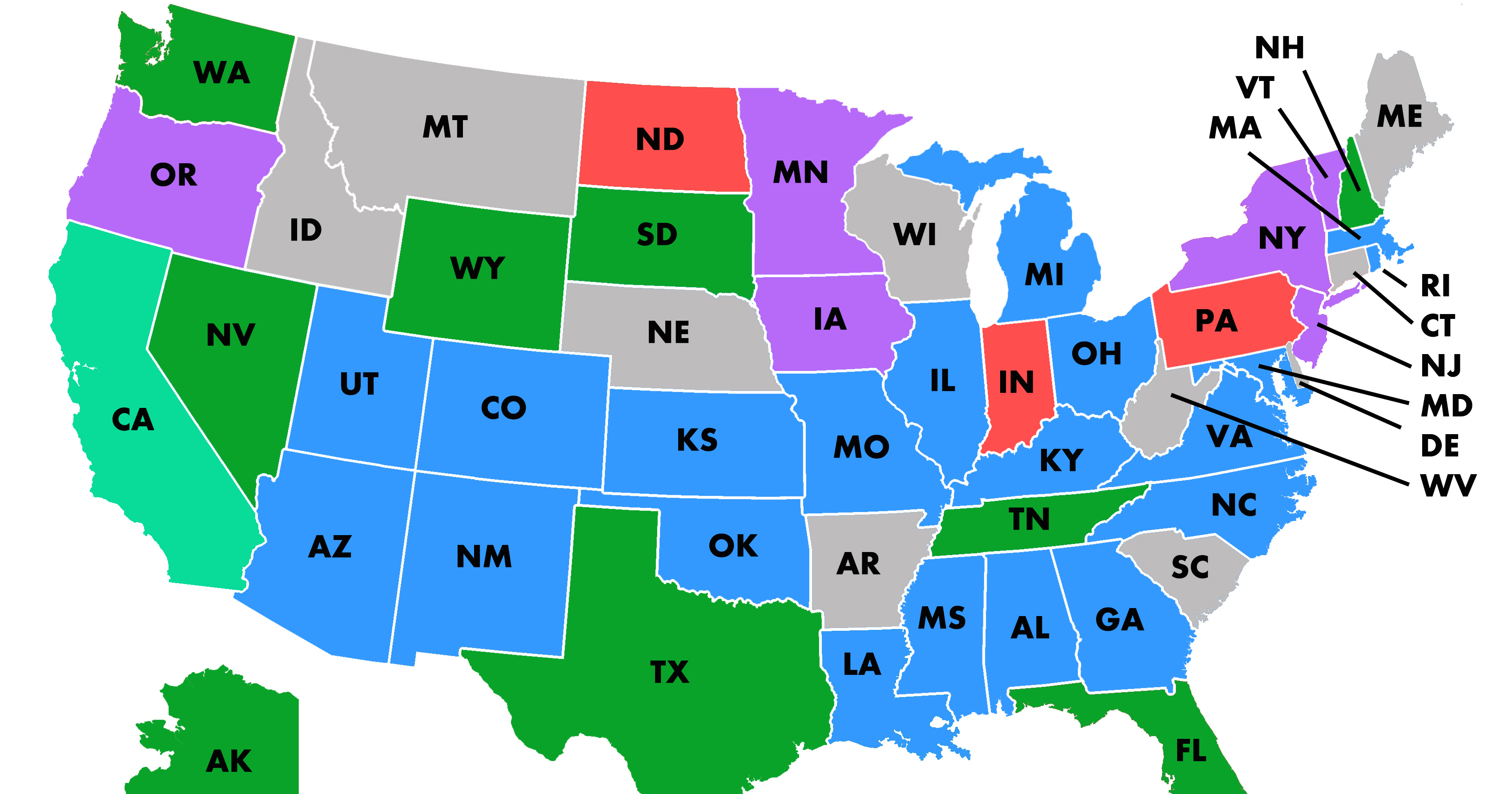

2021 Capital Gains Tax Rates By State

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

Capital Gains Tax In Kentucky What You Need To Know

What Is Capital Gains Tax And When Are You Exempt Thestreet

Will You Have To Pay Capital Gains Taxes On The Sale Of Your Home Charles Schwab

Iowa Legislature Sends Significant Tax Bill To The Governor Center For Agricultural Law And Taxation